how to claim california renter's credit

File your income tax return. If you already filed you would have to amend to claim but if you have not filed yet you can go back and add it to your return.

How California Renters Are Bracing For An Eviction Tsunami California Borrow Money Tsunami

To claim the California renters credit your income must be less than 40078 if youre single or 80156 if youre filing jointly.

. I lived and payed rent in an apartment for all of 2017 and part of 2018. While the rules vary from state to state there are a few things that remain somewhat consistent across state lines. The California Renter Credit is a kind of nonrefundable credit that is worth 60 for individuals and worth 120 for married couples.

To qualify for the Californias Renters Credit you. To claim this credit you must. To claim the renters credit for California all of the following criteria must be met.

Renters Credit that taxpayers currently claim was recalculated using the proposed credit amounts annually increasing the credits based on inflation and then reducing by the amount. Go to the Input Return tab. Select CA Other Credits.

To claim the CA renters credit. The FTB is the state agency that handles the state income tax. If you are taking advantage of this COVID-19-related relief late or missed payments will not be shared with credit reporting.

Go to Screen 53 Other Credits and select California Other Credits. California allows a nonrefundable renters credit for certain individuals. How California Renters Are Bracing For An Eviction Tsunami California Borrow Money Tsunami Browse Our Free 5 Day Notice To Pay Or Quit Template Templates Being A.

The taxpayer must be a resident. California allows a nonrefundable renters credit for certain individuals. File a Married Filing Separate or RDP Return Did not live with your SpouseRDP during the last six months of the year Furnish over half of the household expenses.

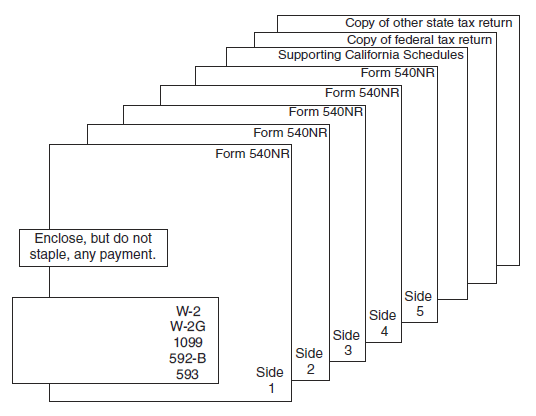

California Resident Income Tax Return Form 540 2EZ line 19. This form of credit is applied directly to your. Visit Nonrefundable Renters Credit Qualification Record for more information.

Part way through 2018 I moved into a room in a. California renters pay 44 above the nationwide median while Californias median household income is 22 higher than the nationwide median according to a report by the. California Nonresident or Part-Year Resident Income Tax Return line 61.

You must be a. Use one of the following forms when filing. Who can claim the renters tax credit.

From the left of the screen select State Local and choose Other Credits. To claim the renters credit for California all of the following criteria must be met. To claim the CA renters credit.

To qualify your household income must fall below a certain threshold. The Renters Tax Credit can be claimed by individuals through the California Franchise Tax Board. I was able to claim the Renters Credit on my 2017 return.

Lacerte will determine the amount of credit. California Resident Income Tax Return Form 540 line 46. Check the box Qualified renter.

Claims for this credit should be. Dozens of California lawmakers are getting behind a bill that would raise a tax credit for renters by hundreds of dollars marking the first potential increase in the tax break in. The taxpayer must be a resident.

The other eligibility requirements are as follows. No credit score changes for accessing relief. If you live in Minnesota for at least 183 days you can claim a renters credit on your taxes.

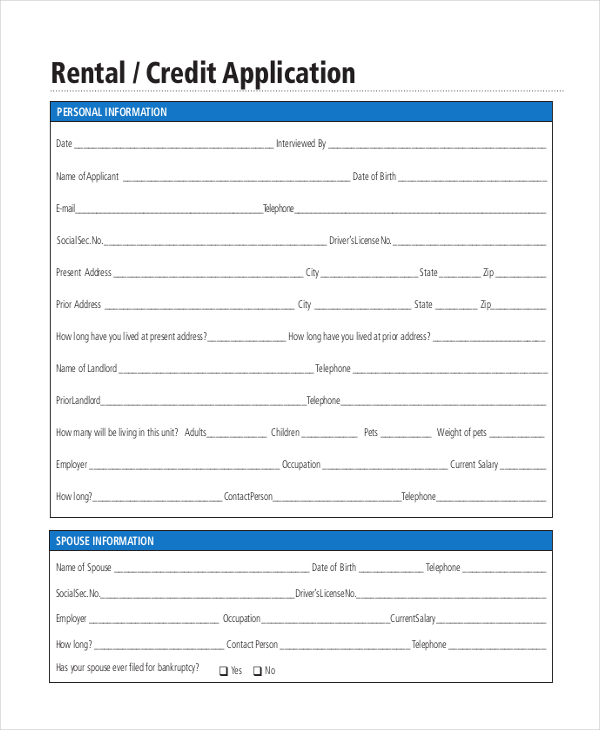

Free 6 Sample Apartment Rental Application Forms In Ms Word Pdf

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

Browse Our Free 5 Day Notice To Pay Or Quit Template Templates Being A Landlord Quites

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

Here Are The States That Provide A Renter S Tax Credit Rent Com Blog

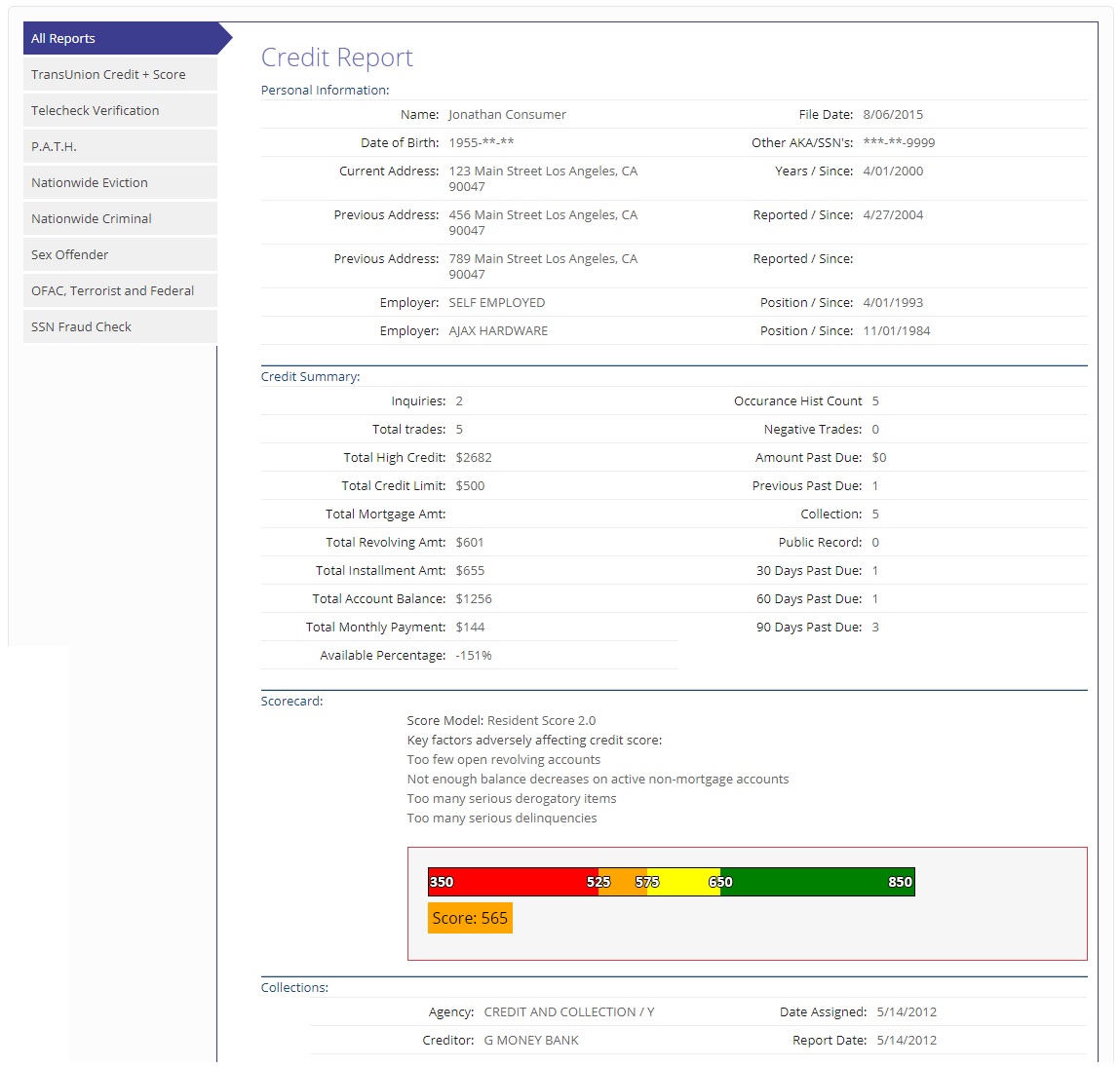

Tenant Background Check Rental Credit Report For Landlords

Free 13 Sample Rental Application Forms In Pdf Excel Ms Word

I Was Sent Someone Else S Rental Car Reservation Miles Quest Dollar Car Rental Car Rental Enterprise Rent A Car

Free 9 Sample Rental Application Forms In Pdf Ms Word Excel

Fillable Form 1040 2018 Irs Tax Forms Income Tax Return Irs Taxes

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

11 States That Give Renters A Tax Credit

Settlement Agreement Sample Check More At Https Nationalgriefawarenessday Com 39514 Settlemen Divorce Settlement Agreement Debt Settlement Divorce Settlement

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

Irs Form 540 California Resident Income Tax Return

Most Expensive Homeowners Insurance Claims By Chad Catacchio Via Flickr Insurance Sales Homeowners Insurance Home Insurance

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor