unified estate tax credit dave ramsey

A real estate investment trustthe cool kids call it a REIT pronounced reetis basically a mutual fund that buys real estate. In real life that means a family paying 30000 a year for day care for two kids would see their Child and Dependent Care Tax Credit go from 6000 to 15000.

The Arkansas Lawyer Winter 2010 By Arkansas Bar Association Issuu

If youd prefer to give away.

. For 2023 it is 1292 million and 2584 million respectively. When you apply for an offer in. In terms of credit card debt Bankrates latest survey found that the average credit card rate was at 1796 as of Aug.

The one ray of hope is that you only pay taxes on amounts above the 1206 or 2412 million threshold. Unified Estate Tax Credit Dave Ramsey. This means that an individual is currently permitted to leave up to 117 million to heirs without any federal or estate gift taxes being.

To file federal taxes youll pay 2500 for Classic and 4500 for Premium Premium comes with IRS audit. The unified tax credit is an exemption limit that applies both to taxable gifts you gave during your life and the estate you plan to leave behind for others. Then there is the exemption for gifts and estate taxes.

31 the highest level seen in decades. Estate tax rates range from 18 to 40. The Unified Credit in 2007 raised to 5 million double for married people and it had a Cost-of-Living Adjustment COLA so it would go up with inflation.

For the tax year 2022 you can give up to 16000 32000 for spouses splitting gifts tax-free to as many recipients. The estate tax is also. What Is a Real Estate Investment Trust REIT.

But just like the. A person giving the gifts has a lifetime exemption from paying taxes on. Before you sit down to file your taxes there are important questions to figure out like How is.

That is up 35 from. Dave Ramsey is an eight-time national bestselling author personal finance expert and host of The Ramsey Show heard by 23 million listeners every week. Any money gifted during your lifetime or after death above and beyond the cumulative unified credit amount of 117 million is subject to estate and gift tax at 40.

This means that an individual is currently permitted to leave up to 117 million to heirs without any federal or estate gift taxes being. Unified Estate Tax Credit Dave Ramsey. Gift and Estate Tax Exemptions The Unified Credit.

This is a type of tax relief that lets you settle your tax debt for less than you actually owe. Debtfree How Much Does It Really Cost. Who Is Dave Ramsey.

Thats not how we do things at Ramsey. Think of it like debt settlement for your back taxes. What You Need to Know and Looking Ahead to 2023 Tax season is here.

Don T Wait On Someone Else To Fix Your Life It S Your Job Youtube

What Is The 2022 Gift Tax Limit Ramsey

How Can I Gift Money To Kids Without Being Taxed Youtube

And Two Become One How To Combine Bank Accounts Ramsey

My Children S Inheritance White Coat Investor

What Is Estate Planning And How Do I Get Started Ramsey

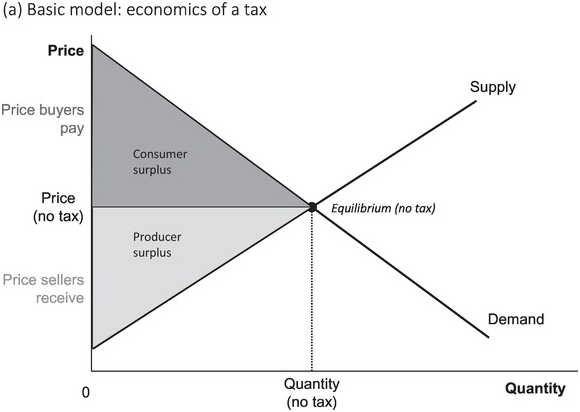

The Incidence Of The Corporation Income Tax Journal Of Political Economy Vol 70 No 3

Principles And Concepts Part I Tax And Government In The 21st Century

Taxation The Lost History Dwyer 2014 The American Journal Of Economics And Sociology Wiley Online Library

What Is The Estate Tax In The United States The Ascent By The Motley Fool

Southington Citizen June 7 2019 By Dan Champagne Issuu

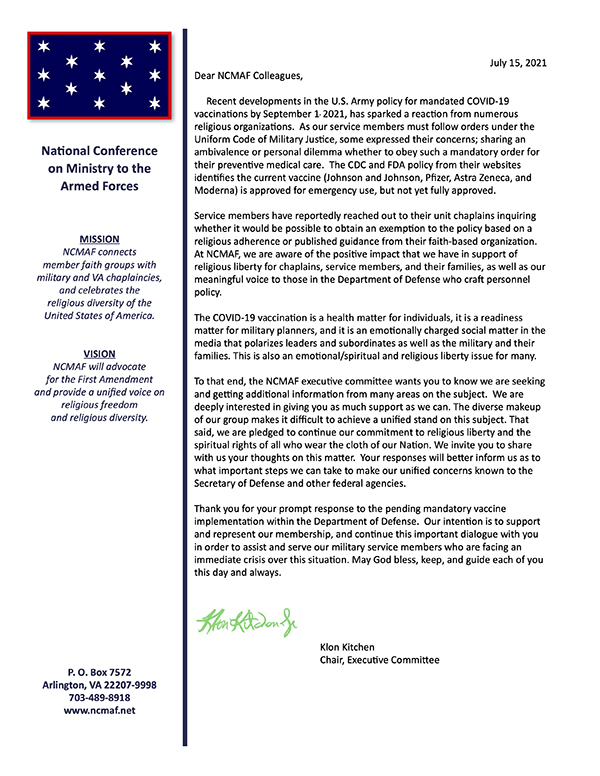

The Coalition Of Spirit Filled Churches

Don T Wait On Someone Else To Fix Your Life It S Your Job Youtube

Dave Ramsey Show Podcast Directory Poor Stuart S Guide

The Latest On The 2020 Election S Key Battleground States The New York Times